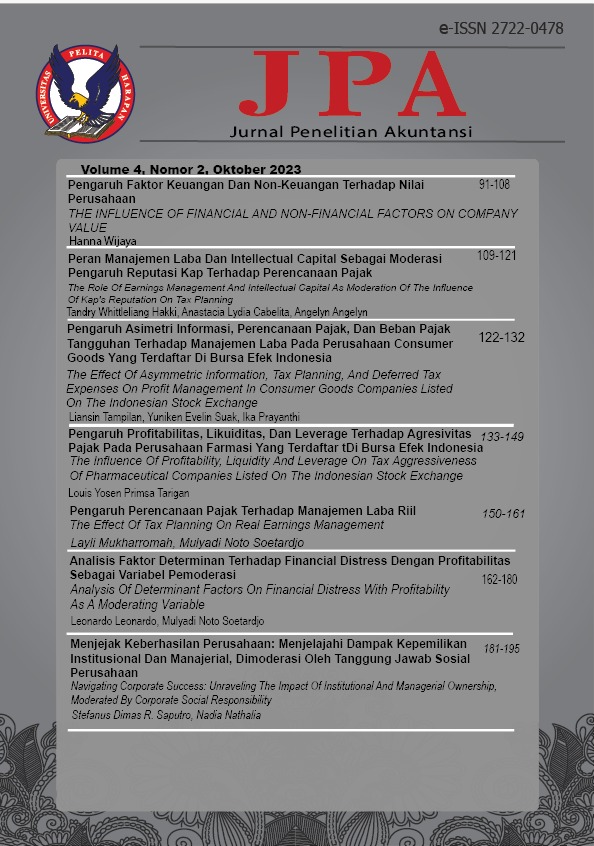

The Influence of Profitability, Liquidity and Leverage on Tax Aggressiveness of Pharmaceutical Companies Listed on the Indonesia Stock Exchange

Abstract

Tax is a vital part to the country's economy and the well-being of its citizens as it is a source of state revenue. However, while the government considers it is crucial to collect taxes, companies view taxes as a reduction of companies’ profits. As a result, businesses strive to keep tax payments to a minimum, either in a legal or illegal way. This behavior is called tax aggressiveness.

This study aims to examine the influence of profitability, liquidity, and leverage on tax aggressiveness. The sample is 8 pharmaceutical companies listed on the Indonesia Stock Exchange with the research period of four years (2018-2021) selected through purposive sampling method. The data analysis technique used in this research is multiple linear regression analysis which is processed through SPSS 26.

The results show that liquidity and leverage have a significant influence on tax aggressiveness. Meanwhile, profitability has an insignificant influence on tax aggressiveness. Simultaneously, profitability, liquidity, and leverage have significant influence on tax aggressiveness.Downloads

Published

Issue

Section

License

Authors who publish with this journal agree to the following terms:

1) Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License (CC-BY-SA 4.0) that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

2) Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

3) Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website). The final published PDF should be used and bibliographic details that credit the publication in this journal should be included.